Pre-paid Payment Instruments (PPIs)

Pre-paid Payment Instruments (PPIs) are defined in the RBI Guidelines issued under the Payment and Settlements Systems Act, 2005 as payment instruments that facilitate purchase of goods and services, including funds transfer, against the value stored on such instruments. The value stored on such instruments represents the value paid for by the holders by cash, by debit to a bank account, or by credit card. The pre-paid instruments can be issued as smart cards, magnetic stripe cards, internet accounts, internet wallets, mobile accounts, mobile wallets, paper vouchers and any such instrument which can be used to access the pre-paid amount.

The maximum value of any pre-paid payment instrument (where specific limits have not been prescribed) cannot exceed Rs 50,000/ (as on October 2015) and they have a minimum validity period of six months from the date of activation/issuance to the holder.

PPIs can be reloadable or non-reloadable. Banks are permitted to issue and reload such payment instruments at their branches and ATMs against payment by cash/debit to bank account/credit card and through their business correspondents (BCs). In the case of non-reloadable PPIs, the outstanding amount in it can be transferred to a new similar PPI of the same issuer, upon expiry.

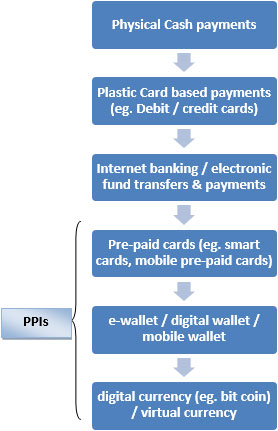

PPIs are one component of the Payment System. In fact, they constitute the last end of the spectrum of payment instruments existing in India at the moment. The Payment and Settlement Systems Act, 2007 (PSS Act, 2007) which came into force with effect from 12 August 2008, provides for the regulation and supervision of PPIs in India. Reserve Bank of India (RBI) is the regulatory authority for this purpose.

The confidence of the public and merchant establishments on PPIs depends on certainty and timeliness of settlement of claims arising from use of such instruments.

Classification of Payment Instruments in India

RBI has broadly classified the PPIs into three categories

- Closed System Payment Instruments: These are payment instruments issued by an entity for facilitating the purchase of goods and services from it. These instruments do not permit cash withdrawal or redemption. As these instruments do not facilitate payments and settlement for third party services, issue and operation of such instruments are not classified as payment systems. Hence, RBI approval is not required for issuing them.

These are issued by companies for in-house goods and services and are sweetened with bonus points and cash backs to ensure the loyalty of their customers. Eg. Many of the web portals for online purchases /shopping - Make my Trip, Flipkart, Jabong etc. run wallets for its customers. Pre-paid cards of mobile companies also belong to this category.

- Semi-Closed System Payment Instruments: These are payment instruments which can be used for purchase of goods and services, including financial services at a group of clearly identified merchant locations/ establishments which have a specific contract with the issuer to accept the payment instruments. These instruments do not permit cash withdrawal or redemption by the holder.

PPIs for amounts upto Rs.10,000/- can be created under this category by accepting minimum details of the customer, provided the amount outstanding at any point of time does not exceed Rs. 10,000/- and the total value of reloads during any given month also does not exceed Rs. 10,000/-. Amount upto Rs.50,000/- can be created in PPIs by accepting any ‘officially valid document’ which is compliant with anti-money laundering rules. Such PPIs are non-reloadable in nature; The above two can be issued only in electronic form;

Amount upto Rs.1,00,000/- can be created by with full Know Your Client norms (KYC) and can be reloaded.

- Open System Payment Instruments: These are payment instruments which can be used for purchase of goods and services, including financial services like funds transfer at any card accepting merchant locations [point of sale (POS) terminals] and also permit cash withdrawal at ATMs / Banking Correspondents (BCs). However, cash withdrawal at POS is permitted only upto a limit of Rs.1000/- per day subject to the same conditions as applicable hitherto to debit cards (for cash withdrawal at POS).

Commonly found PPIs in India

Some of the commonly found PPIs in India are:

- Mobile Prepaid Instruments: The prepaid talk time issued by mobile service providers. This value of talk time can also be used for purchase of 'value added service' from the mobile service provider or third-party service providers.

- Gift Cards issued by Banks, NBFCs and other persons (shops, companies etc): These are non-reloadable cards issued for a maximum validity period of 3 years, upto the specified limit (Rs. 50,000/-). Further, they cannot be redeemed against cash.

- Social benefit cards: Banks are permitted to issue PPIs to Government Organisations for onward issuance to the beneficiaries of Government sponsored schemes (eg. Food vouchers). Here verification of the beneficiary is not the responsibility of banks, but is that of the government organization issuing such cards. They can be loaded / reloaded upto the specified limit (Rs. 50,000 as on October 2015) only by debit to a bank account, maintained by the Government Organizations with the same bank.

- Remittance Cards: These are PPIs issued by banks for credit of cross border inward remittances.

- Corporate Cards: Banks are permitted to issue prepaid instruments upto the specified limit (Rs.50 000 as on Oct 2015) to corporates listed on stock exchanges, for onward issuance to their employees. These are linked to the bank accounts of the employees but fundamental responsibility for identification of the beneficiary lies with corporates and not with banks. These are loaded / reloaded only by debit to the bank account and provides for facility of fund transfer (for the amount remaining on the card) to the bank account of the employee.

- Foreign Travel Cards: These are Rupee denominated non-transferable PPIs issued by overseas branches of banks in India (directly or by cobranding with the exchange houses/money transmitters) for visiting foreign nationals and Non Resident Indians (NRIs). The cards can be issued upto a maximum amount of Rs.2 lakhs by loading from a KYC compliant bank account. However, cash withdrawal from such PPIs are restricted to Rs 50,000/- per month. Such PPIs are activated by the bank only after the traveller arrives in India and can be used only for transactions in India. The transactions are settled in Indian Rupee.

- PPI for Mass Transit Systems (MTS): These are semi-closed PPIs issued by the mass transit system operator (eg. Metro trains, transport corporations etc.) for automated fare collection. Apart from the mass transit system, such PPIs can be used also at other merchants whose activities are allied to or are carried on within the premises of the transit system. They are reloadable in nature and at no point of time the value / balance in PPI can exceed the limit of Rs. 2,000/-.

RBI has decided to rationalise the operational guidelines for PPIs with a view to encouraging competition and innovation, and strengthening safety and security of operations, besides improving customer grievance redressal mechanisms. It is proposed to bring in inter-operability into usage of PPIs. Inter-operability amongst KYC compliant PPIs is proposed to be implemented within six months of the date of issuance of the revised Master Directions, i.e., by October 11, 2017.

Who can issue prepaid payment instruments in India?

Only those companies incorporated in India and have a minimum paid-up capital of Rs. 5 crore and minimum positive net worth of Rs. 1 crore at all the times are permitted to issue PPIs in India.

Banks who comply with the eligibility criteria are permitted to issue all categories of PPIs. However, only those banks which have been permitted to provide Mobile Banking Transactions by the Reserve Bank of India are permitted to launch mobile based pre-paid payment instruments (mobile wallets & mobile accounts). Non-Banking Financial Companies (NBFCs) and other persons are permitted to issue only closed and semi-closed system payment instruments, including mobile phone based pre-paid payment instruments. Non-bank persons issuing payment instruments are required to maintain their outstanding balance in an escrow account with any one of the scheduled commercial banks.

Persons authorized under Foreign Exchange Management Act (FEMA) can issue foreign exchange pre-paid payment instruments and where such persons issue such instruments as participants of payment systems authorised by the Reserve Bank of India, they are exempt from the purview of strict guidelines related to pre-paid instruments. However, the use of such payment instruments are limited to permissible current account transactions and subject to the prescribed limits under the Foreign Exchange Management (Current Account Transactions) Rules, 2000. Otherwise, use of pre-paid payment instruments for cross border transactions are not permitted.

Persons issuing pre-paid payment instruments have to maintain a log of all the transactions undertaken using these instruments. This data is made available for scrutiny by the Reserve Bank or any other agency / agencies as directed by RBI. They also need to file Suspicious Transaction Report (STR) to Financial Intelligence Unit – India (FIU-IND).

Data

- Reserve Bank of India has issued Certificates of Authorisation under the Payment and Settlement Systems Act, 2007 for setting up and operating Payment System in India, including PPIs. The names of entities which have received such certificates for operating PPIs and the names of the pre-paid instruments run by them are given on the website of RBI.

Also see

References

- RBI Master Circular dated 1 July 2015 (updated as on 9 July 2015: for further updates on the matter, latest versions of the master circulars may be seen)